Much is said about the mobile tool Sinpe, which has gained momentum since the pandemic and is used to make money transactions conveniently from wherever you are.

It has a high number of subscriptions so far in 2023, exactly 644,545 people, and since 2016 6,122,326 in total, according to the digital platform of the Central Bank of Costa Rica (BCCR).

If we talk about settled transactions, the year 2022 has the highest amount, although the year 2023 is not over yet.

Financial entities already offer the Sinpe Móvil service, to mention some of them: BCR, Nacional, Coocique, Coopealianz, and the Asociación Solidarista de la CCSS, according to data from the year 2021 allowed sending, free of charge, amounts greater than ¢100,000 per day, also known as the general rule.

Sending money to family and friends through Sinpe Móvil is one of the most constant transactions.

Almost two years ago, a survey was published called Study of Payment Cards by the Office of the Financial Consumer (OCF), elaborated by experts in the economic area, who reported that 90% of the users assured that the operation was the most used.

Six out of 10 people, according to the survey, had the system enabled in their cell phone numbers. At present, the number should be higher.

The report showed that the second most permanent transaction was payments to grocery stores, farmer’s fairs, and fuel stations, the interesting information was the result of 59% of those consulted.

Danilo Montero, general director of the OCF, detailed that the survey was conducted to a total of 1,406 people via telephone, residents of urban and rural areas throughout the country.

How did Sinpe come about?

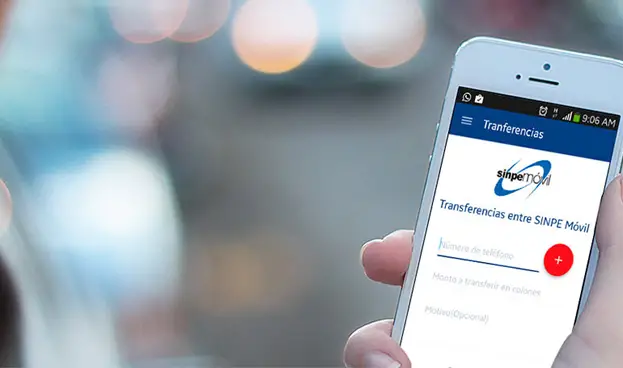

Simple Móvil is a platform created and managed by the Central Bank of Costa Rica, to allow users affiliated with a financial institution to send and receive money to an account associated with a phone number in a more convenient way.

Transactions, of course, are usually made via SMS messages or banking applications.

It is worth noting that, daily -without charging commissions-, the maximum amount of money sent must be ₡100,000 and up to a monthly maximum of ¢2 million.

It is worth mentioning that, to use the Sinpe tool, the person must have a bank account (in colones) in a financial entity, have the online banking service activated, as well as an active telephone number.

Some entities allow the process to be carried out online from the bank’s web page.

To send money you can only enter the banking application, click on “transfer by Sinpe Móvil”, enter the phone number of the person to whom you are sending the money, and the amount and send it.

You can also make the transfer by text message. In this case, in the space designated for the destination telephone number you must type the Sinpe Móvil code of the entity, and in the body of the message you must enter: pase_monto_número destino_motivo (the low lines correspond to blank spaces).

The money arrives in real time and the service can be used 24 hours a day all year round.

Details about Sinpe Mobile

The platform’s design offers customers a secure, interoperable, easy-to-access payment mechanism with wide coverage and high availability.

The same funding account can be linked to one or more cell phone numbers.

The client affiliates as many cell phone numbers as wishes to link to the service.

You can check the balance in the account linked to the telephone number.

In addition, you can check the latest movements of funds applied to the account.

What happens if you send money to the wrong number?

And as I said at the beginning, not everything looks colorful, because in life anything can happen and in SINPE Móvil too, what do I mean by that? There is a possibility that someone makes a mistake and sends funds to the wrong number, but if that happens, what should the customer do?

In Costa Rica thousands of transactions are made daily through Sinpe Móvil, it is one of the most used methods to make payments and transfers, which is a great benefit. But in the back and forth, through distractions you can make a mistake and transfer to the wrong accounts, some are lucky enough to get their money back, others are not.

Both the person who sends the money in error and the person who receives it without having something pending must seek a solution.

Of course, the person who made the mistake is entitled to a refund and must call the bank to cancel the transaction or send an e-mail to the entity’s Comptroller of Services, so that they block the money because there was a mistake; also the bank must provide the data of the person who received the money by mistake, the telephone number, e-mail, the person must be contacted.

In case You does not return the payment, You must go to court. The most appropriate thing to do in case of a transaction that you receive that is not yours is to go to a bank and return it