This time of the year is characterized by worried parents that will have to face all financial challenges that come with their kids returning to class. For a worried parent, these challenges mean school payments, uniforms, school supplies and so on, which at the end of it translates into serious expenses, and they know of course that these expenses are necessary to invest in their kid’s education. Therefore, some recommendations on how to buy without going out of the budget might come in handy. So, first things first, facing these economic challenges with a responsible attitude might actually save time and money; here are some tips on how to do that:

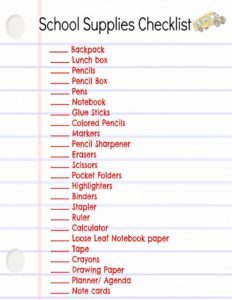

- Shopping list. Ideally, having a well-specified shopping list that sums up what are the school supplies that the institution asks for, will set up a clear path on what needs to be on the budget and what does not. This listing will help the parents to stay focused on what is really necessary and consequently will end up in saving some money.

- Financial Literacy. All the effort for growing in financial literacy is never in vain because this knowledge will be very useful to be certain on what the next steps will be. It is key to know the basics, for example, learning how to do a budget, what is an income over expenditure relationship and other important financial principles.

- Know where to get the money. The ideal strategy here would be to evaluate different financing options, to do that is essential to know what are the banks offering regarding personal credits or verify what are our possibilities on increasing our own credits. Also, to make decisions like this it is important to know our credit cards statement or even our financial statement and then starting to plan the best course of action.

- Establishing the budget. Once we get to know the list of school supplies and the amount of money needed, the next step will be going shopping. However, to establish the budget it is important to take into account fixed and temporal incomes, for example, bank credits, also usual and temporal expenses such as school expenses. In this way, our budget will let us know what to invest without leaving on aside other responsibilities translated into service payments, fees, house lease, medical insurance etc.

This is a new way to reuse school utensils such as erasers, colors, pencils, notebooks. In addition, this practice goes hand in hand with promoting a culture of environmental awareness which would be a positive educational topic of conversation for our children.

Taking into account financial advice to face school expenses will be advantageous for personal and family finances, also being clear on domestic economy concepts will be beneficial when evaluating any future decision-making.